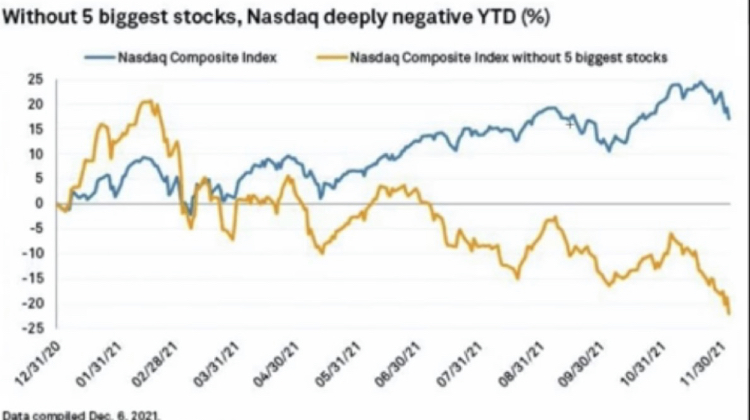

The S&P 500 is having another monster rally to close out the year and is just shy of a 30% return YTD. As mentioned in an earlier post: eye-popping returns. But look closely and you’ll see that the bulk of the success is due to just 5 companies: Apple (APPL), Microsoft (MSFT), Amazon (AMZN), Tesla (TSLA) and NVIDIA (NVDA). An interesting graph below shows that if you remove these planetary giants from the Nasdaq Composite Index we go from a 25% gain YTD (as of today) to a near -25% loss. Market forces of passively run index funds keep rewarding the biggest market caps and are literally pulling investment money into their orbit due to respective size. The constant growth in stock price of the giants is wonderful for broad mutual fund holders, but it means investment weight within index portfolios is unequally distributed and creating a divestment vicious cycle for smaller companies.

“Stocks in the S&P 500 are faring better, with 68% of constituents trading above that moving-average mark. Still, just five stocks – Apple (AAPL.O), Microsoft (MSFT.O), NVIDIA (NVDA.O), Tesla (TSLA.O) and Alphabet (GOOGL.O) – have accounted for about half of the index’s gain since April, data published by Goldman Sachs earlier this week showed. The S&P is up about 24% for the year and stands near record highs.”

–Wall St Week Ahead Narrowing market breadth may be worrying signal for stocks, Saqib Iqbal Ahmed, Reuters (12/17/21)

Who is to say how this game plays out in 2022, but if there is any kind of panic sell-off among the top five it will have a drastic impact on index funds overall. Note that Tesla (TSLA) has a market cap of $1.1T with a P/E ratio of 355… that’s a lot of catching up to do.

“Learn from yesterday, live for today, hope for tomorrow. The important thing is not to stop questioning.” –Albert Einstein