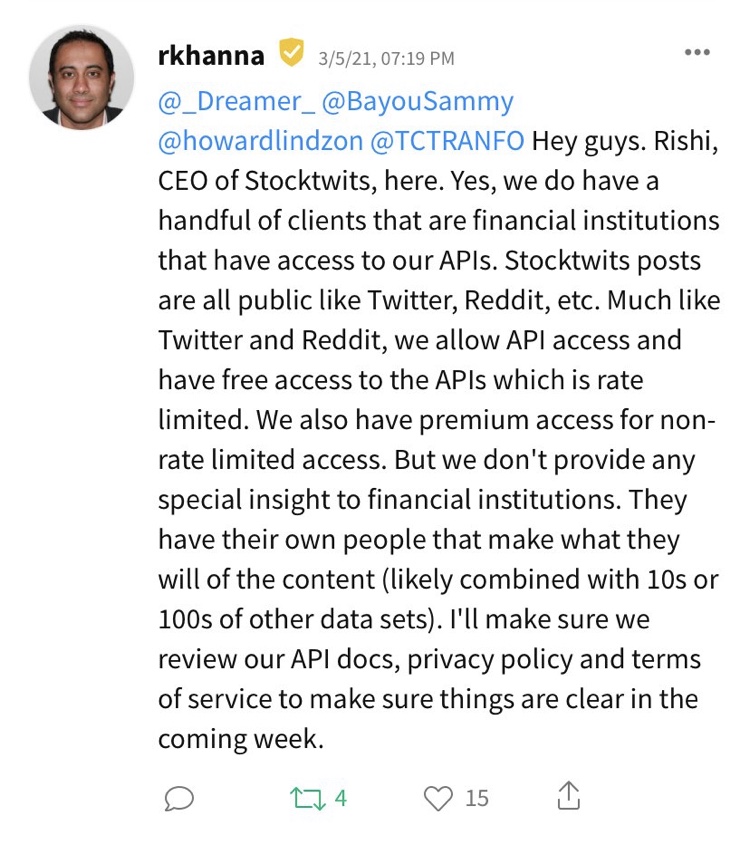

Retail investors have enough of an uphill battle as is, constantly dealing with the whiplash of the market (last week was rough!) and having to guess where the next surprise might be lurking. It’s particularly hard when hedge funds/private equity can add more fuel to the fire with their substantial capital resources and proprietary access to the market. But the recent rumors that Robinhood and Stocktwits are selling retail investor sentiment data to hedge funds is outright enraging; it basically means they have exclusive information in which they can potentially coordinate “short attacks” against retail investors, driving us out of our positions if we use instruments like stop-losses, option plays or simply are panicking and selling.

It’s pretty rich to accuse Reddit readers of nefarious activity when they pushed back against the hedge funds, squeezing them on GameStop and other meme stocks. Beyond targeted rebellious activity, what can retail investors do to safeguard their investments (and sanity)?

- Remove stop-loss triggers As this is what hedge funds are hoping to set off so they can make money on the dip with puts, while also buying your shares cheap.

- Buy. Hold. Accumulate. If you don’t sell your shares, and in fact buy more when they dip, you are winning the dollar-cost-averaging game.

- Don’t mess around with options When hedge funds have your sentiment data they know retailers are placing call options betting that a stock will go up and can maximize burning you by doing the opposite and driving the stock price down. They are cheating—using sentiment data from Robinhood and Stocktwits—so don’t let them win and refrain from options plays. Who else got clobbered last October on Limelight Networks (LLNW)?

- Stop using BEAR and BULL flags on Stocktwits Don’t give the hedge funds/algos any signals to work with.

Sunshine is definitely the best disinfectant and the more we understand how this complex game is played, the better we can protect ourselves from being manipulated by hedge funds/private equity. We are smarter than the Wall Street bros, which is why they resort to dirty tricks.

“Pay no attention to that man behind the curtain! The Great Oz has spoken!” -Wizard of Oz

Insightful, precise and useful information as always. Thank you