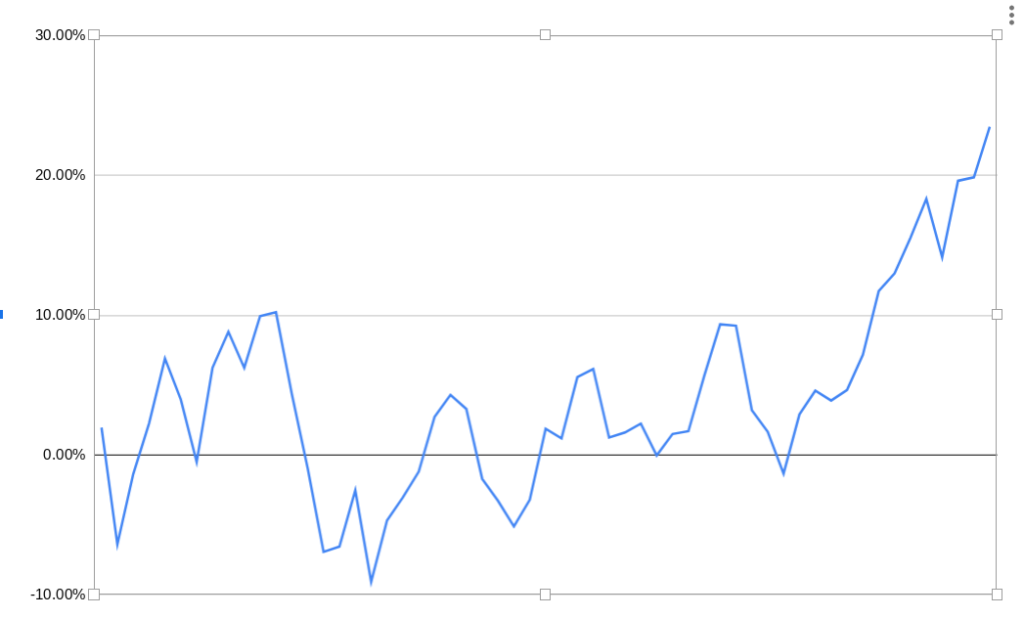

After some serious turbulence getting off the ground, the past 12 weeks have been great for the ADP Phoenix Forty group of securities. The graph below indicates an average gain of 23.5% over that time period. Minor adjustments to the list have been made during this time and like how Trader Joe’s will replace 5% of their inventory to introduce new products, I reserve the right to very occasionally move out companies for more promising ones. And with that said… let’s keep on keeping on!

Rubius (RUBY) $72M

Curis (CRIS) $105M

Axcella (AXLA) $122M

Puma Bio (PBYI) $159M

Jounce (JNCE) $243M

1stdibs.Com (DIBS) $274M

Viant (DSP) $334M

Ranpak (PACK) $524M

Vaxart (VXRT) $526M

fuboTV (FUBO) $806M

Materialise (MTLS) $812M

Altimmune (ALT) $842M

Perion (PERI) $974M

DocGo (DCGO) $1B

Nextdoor (KIND) $1.2B

Digi (DGII) $1.2B

PubMatic (PUBM) $1.2B

Proto Labs (PRLB) $1.3B

Magnite (MGNI) $1.3B

Veru (VERU) $1.5B

LiveRamp (RAMP) $1.5B

Xperi (XPER) $1.7B

Celldex (CLDX) $1.8B

Digital Turbine (APPS) $2.3B

Ballard Power (BLDP) $2.7B

Novavax (NVAX) $3.2B

StoneCo (STNE) $3.8B

Opendoor (OPEN) $4B

DoubleVerify (DV) $4.5B

SunPower (SPWR) $4.6B

DigitalOcean (DOCN) $4.7B

New York Times (NYT) $5.6B

Ginkgo Bio (DNA) $6.5B

Doximity (DOCS) $7.3B

Zillow (ZG) $9.6B

Roku (ROKU) $11.6B

First Solar (FSLR) $12.6B

Plug Power (PLUG) $17.1B

Skyworks Solutions (SWKS) $18.2B

Trade Desk (TTD) $36.4B

“Energy and persistence conquer all things.” –Benjamin Franklin

Dude, Teach Me

I wish I could figure out my methods, but basically I believe the future is green energy, additive 3D printing, programmatic advertising and biotech. I select promising and proven companies that are undervalued, and then do a buy-and-hold strategy. See the rest of the blog for more. I’ll get back into dissecting individual companies in greater detail soon.

The thesis makes sense enough. I guess it’s just striking that you can have such an apparently intimate knowledge of so many companies across all those esoteric sectors. Picking micro-cap biotech winners?? I’m just beginning to wrap my head around ad-tech … but then again i suppose i just got started.

Speaking of which, got any thoughts on ADTH?

Well I’m starting to ramp back up after a devastating 18 months, so let’s see how the thesis continues to hold up in the coming months. For biotech I do like the Boston area for a being a hotbed of activity/cross pollination and think that one (or more) of those micro caps could launch big with the right research advancement. I’ll look into ADTH and get back to you.

case and point… check out Curis (CRIS) today

Another day, another one (or several) of your picks shooting up. And here I am doing a Peter Lynch one-at-a-time thing like an asshole. (Or maybe not — I’m real heavy on Maggie now, so we’ll see.)

It’s easy enough to buy into biotech from a general, long-term standpoint. And it’s all the more tempting from a relative near/middle-term standpoint with looming economic headwinds. But how anyone w/o specific industry expertise can evaluate their prospects is a bit of a mystery. It all seems so highly speculative. I know they don’t ALL have to blow up for it to work, but still.

And yet it’s almost like you knew the FDA was going to lift it’s partial clinical hold on the TakeAim study (or something???).

So I sent that article to my friend, who’s a blood cancer research doctor in residency at Mass-Gen. He doesn’t know anything about stocks, but this is what he said: “It’s a bit of a long shot, but it might work out. Targeted therapies in lymphoma tend to be disease-managers, not cures, and most have not worked out at all. A few have been really useful. I wouldn’t be able to say whether this is going to be useful or not until seeing results from the trials.”

Response?

So you have to step back and look at the forest instead of the individual trees: the biotech sector is going to eventually dwarf the dot.com/digital industry boom that began in the late 90s. A biotech like Moderna (MRNA) will someday have the size and influence of a company like Apple. And instead of Silicon Valley/Bay Area, this tech revolution is happening in the greater Boston area. Your friend is in residency… but is he aware of all the lab space being built out everywhere? So you are correct that it is indeed speculative to invest in micro-caps, but if you have a decent spread of them and buy when their market caps have been depressed (which happened pretty recently), you are playing some good odds that one (or more) of them will hit it big. The other sector I forgot to mention that I invest in is IoT (Internet-of-Things). So with Additive 3D Printing, Biotech, IoT, Programmatic Advertising and Green Energy (for power, storage and transportation) you have a good group of companies for growth as they are the future. I like David Gardner from Motley Fool and Jeremy Rifkin (read Third Industrial Revolution and The Zero Marginal Cost Society).

And regarding ADTH, it looks intriguing but I’m wary of SPACs because I feel like there are always these funding catches attached (is the share float “truly” the float… how much more dilution is coming down the pipe?). Also I see from their earnings report that they are doing okay, but doesn’t look super great. The 100%+ gain in CTV caught my attention, as that is where the real money is gonna be with programmatic. It looks a little early for me to invest personally, but the market cap is so low the risk seems slight in that you are probably getting in near the bottom.

Wow, good stuff. Thanks for indulging me.

The forest for the trees is about what I figured, but l def. did not appreciate the budding scale we’re talking about in regards to that Boston biotech hotbed.

I’ll def check out some David Gardner on how to pick ‘em and at least one of those David Rifkins (thank you Audible).

Probably some good points re: ADTH. Appreciated.

David Gardner is out of the stock picking game a bit (he has a podcast now) but I like his style of investing and the book he co-wrote with his brother Tom is good to read. Of the two Jeremy Rifkin books I mentioned, I’d select Third Industrial Revolution if you are going to look into one.